What is ESG data? Examples, uses, issues

As more companies are judged on their sustainability profile, ESG data has become critical. Learn what it is -- including examples -- and why it’s important.

In the sustainability realm -- as in other areas of business -- data is key to gaining a competitive edge.

More stakeholders are demanding that companies focus on environmental, social and governance (ESG) efforts. Data provides raw material that IT, sustainability and business leaders can use to benchmark their company's practices and assess risks. ESG data also forms the basis for strategic decisions and improvements. And critically, ESG data helps to prove that a company has sustainable, fair and ethical practices to legislators, supply chain partners, consumers and employees.

This data is particularly important today as investors increasingly turn to ESG data providers -- companies that focus on gathering and analyzing companies' sustainability and related practices -- to help make decisions about where their money should go.

However, the ESG landscape is complex, and that extends to the concept of data. This article provides a primer to dispel some confusion. It covers the following areas:

- What ESG data is, with examples.

- What data companies gather.

- How ESG data is used.

- An overview of ESG scores.

- Challenges with collecting and reporting ESG data.

- The IT leader's role in gathering and reporting ESG data.

What is ESG data?

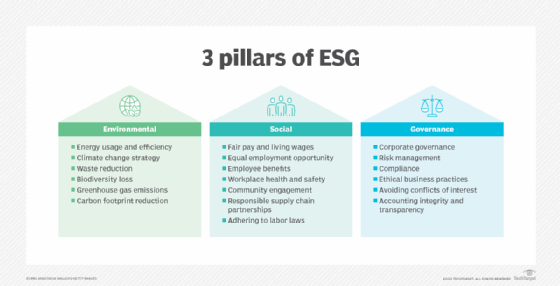

At its simplest, ESG data refers to information that organizations could collect under the header of environmental, social and governance activities.

Environmental data

The "E" in ESG covers how a company uses natural resources and what impact it has on the environment. Examples of environmental data include:

- Energy use.

- Water use.

- Greenhouse gas emissions.

- Biodiversity impacts.

- Pollution levels.

- Amount of waste sent to landfill.

Data on carbon emissions is one of the most important in this category. More organizations are tracking and reporting on their greenhouse gas (GHG) emissions to meet regulatory requirements, to inform their own sustainability decisions or to share with stakeholders, such as business partners and customers.

However, some organizations might need to get more granular by measuring their energy use in more detail. For instance, some might want to calculate how much of their energy comes from renewable resources so they can tell whether they're meeting self-imposed milestones on their journey to become carbon neutral. Similarly, organizations might want to collect and record data on how much water they use, the volume of raw materials they consume, how much waste they produce, and how much waste can be recycled.

Social data

The "S" of ESG focuses on the fair and just treatment of people, both inside the company and as part of business operations. It too includes a wide range of data companies could collect. Examples of social data include:

- Diversity statistics.

- Workplace safety issues.

- Substandard wage levels.

- Product quality problems.

- Community engagement efforts.

- Dollars contributed to nonprofits.

Diversity, equity and inclusion (DEI) data is a prime example of the social component of ESG. Many organizations collect data about employees' race, gender and age to help understand the fairness of their employment practices, help establish DEI program strategies and track those programs' progress. Some of that data collection might be for regulatory requirements, while some might be for internal scoring. More organizations are going further, for example, gathering data on compensation figures and personnel employment histories for all workers, so they can determine whether the organization has equitable pay across gender and racial lines.

Supply chains are becoming an important area of focus for the "S" of ESG. Their out-of-sight, out-of-mind complexity makes injustices, working conditions and other negative impacts easy to overlook. In response, more organizations are working to gain greater visibility into their supply chains to verify that their suppliers uphold human rights, don't use forced labor and aren't violating specific labor-related standards. Some companies are even mandated to gather supplier-related information by regulations such as Germany's Supply Chain Due Diligence Act (SCDDA), in effect since January 2023.

Governance data

The "G" in ESG covers the frameworks and decision-making processes that control a company and its resulting operations. Data that falls under the governance umbrella includes the following:

- Board diversity profile.

- Shareholder rights.

- Ethics.

- Political activities and affiliations.

One important area of governance data is a company's board composition in terms of gender, ethnicity, age and experience. Executive compensation and political donations are also critical data points. Other factors include business integrity and anti-corruption practices; corporate leadership's approach to strategy, decision making and compliance; and the company's competitive practices.

As compared with environmental and social factors, many organizations have a longer history of tracking and measuring their governance programs -- and thus gathering governance data -- than they do their environmental and social impact. The data gathered to report on the governance function focuses on accountability, assurance, efficiency, fairness, leadership, responsibility and transparency -- basically measuring how justly corporate leadership and boards discharge their duties.

Qualitative vs. quantitative ESG data

In all three areas, both quantitative and qualitative data play a role. Quantitative data is concrete, numbers-based and measurable, while qualitative data describes and interprets.

For example, quantitative data can describe the organization's carbon emissions, whereas the qualitative data can provide context for why emissions have gone up or down. In the governance arena, the corporate board's gender makeup and board member compensation are examples of quantitative data. The perceived adequacy of corruption controls, which relies on stakeholder perception and description, is a type of qualitative data. An example of quantitative data in the social arena is the number of data breaches, while qualitative data in this area would be storytelling around the low number of women in leadership at the company or why the demographic composition at a company is homogenous.

Due to the complexity of many issues covered by ESG, there is currently an overreliance on qualitative data, which can make comparisons and progress tracking difficult.

Data interdependency

Much of the data related to ESG issues crosses multiple areas. For example, pollution affects people and is an issue that's impossible to separate from the ethics of a company. Animal welfare is another area of ESG risk with multiple sustainability impacts, and it is getting more attention as companies come under fire for cruel and polluting practices.

What ESG data do companies gather?

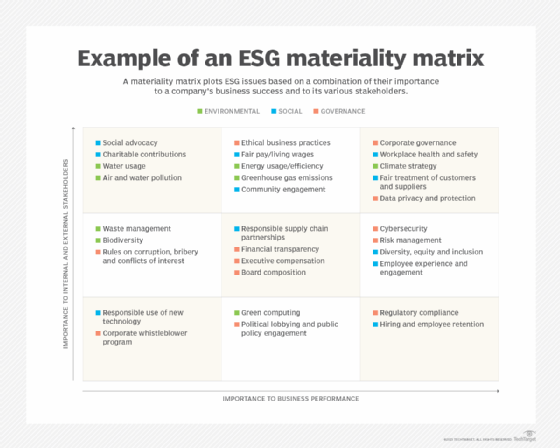

Not all possible ESG data points are relevant or important to an individual organization. That's why organizations must determine what data is required or otherwise important to gather and report.

Organizations narrow that potential selection by undertaking an ESG materiality assessment. This process identifies which environmental, social and governance factors are most relevant to its success and which activities and results to measure and track. The objective of a materiality assessment is to identify what data is needed -- and therefore material -- to the organization so that the organization can inform stakeholders, meet regulatory requirements and measure progress toward ESG goals. Numerous frameworks exist to guide organizations through a materiality assessment and help them identify what data to collect in each of the three ESG categories based on their industries, goals and legal needs.

More companies are choosing to hire an external entity to conduct an ESG audit as part of this process. An ESG audit is an assessment of a company's environmental, social and governance risks, which is most commonly used to verify data in ESG reporting but can be part of the materiality assessment stage.

How is ESG data used?

Organizations use ESG data to set, track and measure their ESG-related initiatives and to create reports that investors, business partners, lawmakers and analysts can use to assess an organization's impact, risk and compliance. An organization can also demonstrate to employees and consumers its commitment to corporate social responsibility.

Regulatory requirements sit at the top of the list of possible uses, as organizations have no choice but to report on certain ESG factors as required by law. Moreover, the number of regulatory reporting requirements are growing. The most notable new addition is the European Union's Corporate Sustainability Reporting Directive (CSRD), which in 2024 started its phased-in implementation.

Organizations collect ESG data for reasons beyond regulatory reporting requirements, however. Many gather, analyze and report such data to do the following:

- Inform their executives on the status of their environmental, social and governance programs so they can determine whether they're meeting expectations or goals.

- Share with their business partners and suppliers, who might need it for their own regulatory reports or to meet their own ESG-related goals.

- Share with other stakeholders, such as employees, customers and investors, who are increasingly seeking such information to decide with whom they want to do business. For example, ESG investing is a category of investing that uses ESG metrics in addition to more traditional metrics to determine which companies to put money into.

- Identify areas of success in their ESG efforts that could differentiate them from competitors.

ESG scores

The growing stakeholder interest in an organization's ESG performance has given rise to ESG scores.

Consulting groups and nonprofit organizations as well as financial and investment firms are among the institutions that issue ESG scores. These entities use an organization's ESG data to rate the organization's efforts against a set scoring system, thereby allowing an organization to be benchmarked against the system and the other organizations being scored.

Well-known ESG score providers include the following:

- Bloomberg.

- CDP.

- Fitch Ratings.

- FTSE.

- ISS.

- Moody's.

- MSCI.

- Refinitiv.

- S&P Global.

- Sustainalytics.

Challenges with collecting, reporting ESG data

Despite the growing number of demands for ESG-related data, many organizations struggle to collect, understand and report on all their environmental, social and governance efforts.

There are myriad reasons for their challenges. Here are just a few:

- Executives often still struggle to identify what data points are most important to them and their stakeholders, as lawmakers and government agencies continue to pass new regulations and other organizations continually update the data points they're seeking from organizations.

- Some data is outside the direct control of a company, making it difficult to capture correct information. Such is the case with Scope 3 emissions, i.e., all the indirect emissions that aren't included in the narrower indirect emissions of Scope 2, which relate to purchased energy.

- Frameworks and models for assessing emissions, energy and other data can be inexact, in conflict with one another and more. Or frameworks simply don't exist for nuanced issues such as around social factors.

- Extracting and collating the needed data from the various sources where the data is generated and stored, as the data points typically reside in different formats in different applications.

The IT leader's role in gathering, reporting ESG data

IT leaders and their teams have a critical role to play in their organization's ESG efforts, both in terms of enterprise technology sustainability and in terms of the organization as a whole.

CIOs and other relevant IT leaders should collaborate with their executive colleagues to set the organization's ESG priorities and goals and then run their IT departments in ways that align with those. For example, if an organization sets aggressive goals to cut its GHG emissions, the CIO should ensure they are using green computing principles. IT leaders should work with their teams and software providers to ensure that the IT infrastructure -- including on-premises data centers and cloud services -- uses renewable energy where possible and limit emissions and environmental impact. Carbon accounting software is likely to be involved in this effort.

IT leaders must also partner with their executive colleagues to identify what data the organization needs to gather, monitor, and report on as part of its ESG efforts. They also need to create the data pipelines that deliver the needed data and then ensure that delivered data is accurate, timely and well secured.

IT leaders will also be key in selecting and deploying the ESG software that can best enable their executive colleagues to analyze and understand the data as well as report the needed data and analysis to stakeholders.

Mary K. Pratt is an award-winning freelance journalist with a focus on covering enterprise IT and cybersecurity management.