ESG strategy and management: A guide for businesses

ESG initiatives can help boost business success. This guide takes an in-depth look at creating and managing an ESG strategy to benefit a company and its various stakeholders.

For companies of all sizes, environmental, social and governance issues have become key business considerations. Corporate ESG policies and practices are closely watched by investors, employees, customers, government officials and other stakeholders. That makes an effective ESG strategy underpinned by strong management processes increasingly important to long-term business success.

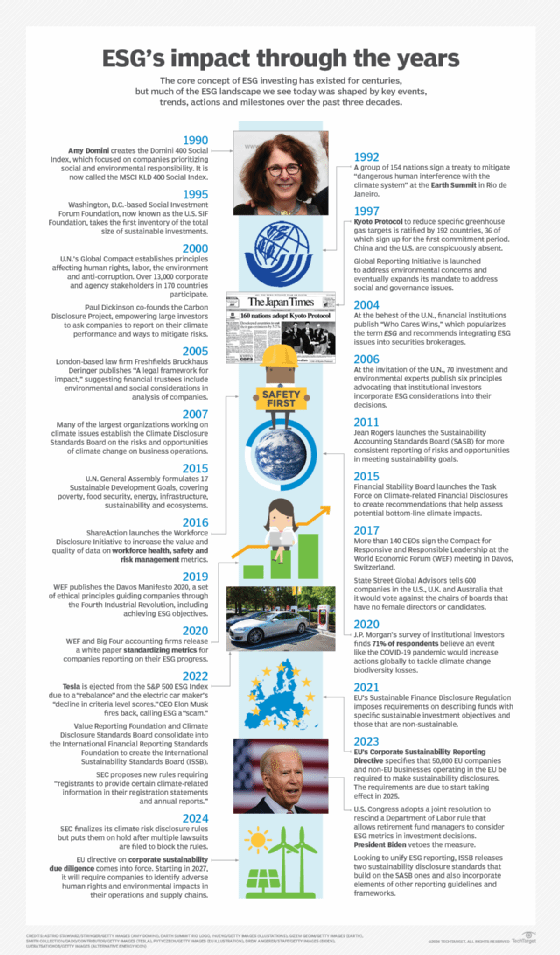

ESG isn't a new phenomenon. The history of ESG investing, in which investors use ESG criteria to help evaluate companies, dates back to the period from 2004 to 2006. In those three years, the term ESG was popularized, a legal framework for factoring ESG information into investment decisions was outlined, and a set of six ESG investing principles that's still used today was published -- all efforts driven by the United Nations. ESG investing's core values can be traced even further back to the socially responsible investing practices that started to take shape in the 1960s and 1970s and became more formalized over the next two decades. But ESG initiatives in companies have been thrust into the spotlight in recent years because of increasing pressure -- from both inside and outside organizations -- to improve environmental sustainability and act in socially responsible ways.

Studies have shown that most large companies have put some form of an ESG program in place. For example, well over 90% of the companies in the S&P 500 publish annual sustainability reports, according to research done yearly by Governance & Accountability Institute Inc., an ESG consultancy. Companies in the Russell 1000 Index have also reached the 90% mark.

But many ESG efforts aren't fully formed. In a January 2024 survey by professional services firm Deloitte, only 25% of 300 senior executives reported that their company made significant progress toward meeting sustainability goals during the previous 12 months; another 60% reported moderate progress. Also, just over half of the respondents -- 52% -- said their organization had created a cross-functional ESG council or working group, while 37% were working to establish one and 9% were only in the planning process. Two percent said their company had no plans for one.

This ESG strategy and management guide explains what ESG involves and how it can benefit companies. You'll also find guidance on creating an ESG strategy and measuring a company's performance on ESG issues, plus information on frameworks for ESG reporting, common challenges and software that can help manage ESG initiatives. Throughout the guide, hyperlinks point to related articles that cover those topics and others in more depth.

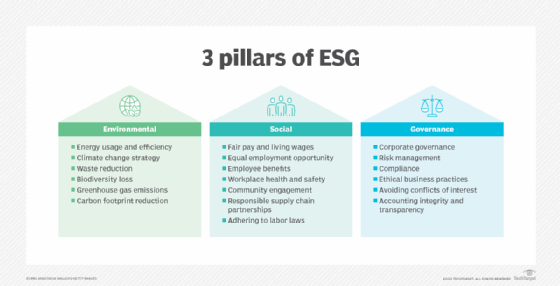

The 3 pillars of ESG

ESG focuses on various issues related to environmental, social and corporate governance practices. An ESG program documents a company's impact on the environment and on different stakeholders as well as its approach to governing business operations and employee actions. Potential ESG-related business risks and opportunities in each of the three areas are also assessed so they can be managed and acted upon. Here's a breakdown of the key ESG factors to consider as part of corporate initiatives:

- Environmental. Examples of environmental factors include energy consumption; water usage; greenhouse gas emissions and overall carbon footprint; waste management; air and water pollution; deforestation; biodiversity loss; and adaptation to climate change.

- Social. The social factors of ESG involve a company's treatment of employees, supply chain workers, customers, local communities and other groups of people. Examples include fair pay and living wages; diversity, equity and inclusion (DEI) programs; workplace health and safety; fair treatment of customers and suppliers; responsible sourcing; oversight of supply chain partners; community engagement; charitable donations; and social advocacy.

- Governance. This involves the internal management practices, policies and controls that govern how a company operates. Examples include the composition of senior management and the board of directors; executive compensation; financial transparency; regulatory compliance; risk management; data privacy and protection policies; ethical business practices; and rules on corruption, bribery, conflicts of interest and political lobbying.

ESG is closely related to business sustainability and corporate social responsibility (CSR), two other concepts that look beyond standard profit-and-loss calculations. But there are clear differences between the three concepts. Business sustainability focuses more broadly on positioning a company for ongoing success through responsible management practices and business strategies, while CSR is a self-regulating approach to taking actions that have societal benefits. By comparison, ESG is a formalized strategy that includes measurable goals and processes for tracking, managing and reporting on them.

How can ESG initiatives benefit businesses?

From a general standpoint, ESG programs can contribute to business sustainability efforts and ensure that there's a commitment to -- and accountability for -- responsible and ethical practices in companies. Those things can pay long-term dividends, but there are also more immediate reasons for companies to invest in ESG strategies. The following are five specific business benefits of ESG initiatives:

- Competitive advantages over business rivals. Companies with successful ESG programs can improve their market position and brand strength compared with competitors.

- More attractive to ESG-focused investors. ESG investing has become a significant part of capital markets. In an October 2023 Morgan Stanley survey, 54% of 2,820 individual investors in the U.S., Europe and Japan said they likely would increase their sustainable investments in the next 12 months. At the institutional level, the U.S. SIF Foundation said in a December 2022 report that $8.4 trillion in assets were being managed in the U.S. using ESG and sustainable investment approaches. That amounted to 12.6% of all investment assets under professional management.

- Better financial performance. ESG initiatives can help improve a company's overall financial performance by reducing energy bills, operating costs and other expenses -- in addition to potentially driving higher sales.

- Increased customer loyalty. Companies that adhere to ESG principles can more easily attract and retain customers who apply ESG considerations in buying decisions. In a 2024 PwC survey, 46% of 20,662 consumers worldwide said they buy products that are more sustainable or have a reduced climate impact -- a data point that shows many consumers do care about ESG issues. Another 2024 survey, conducted by TechTarget's Enterprise Strategy Group division, found that 71% of 435 IT and data professionals think their company would pay more than a 5% price premium for products or services from IT vendors with strong sustainability practices.

- More sustainable and adaptable business operations. It's also easier for companies with well-managed ESG strategies to adapt to changes in regulatory and legal requirements, as well as the effects of climate change, depletion of natural resources and other environmental issues.

In addition, ESG initiatives can increase employee engagement, make it easier to hire and retain workers, reduce business risks and improve the standing of companies in the communities where they have operations.

How to create an ESG strategy

Companies should incorporate various ESG trends, practices and ideas into their plans. Some examples include reducing greenhouse gas emissions, implementing climate adaptation measures, creating more responsible and sustainable supply chains, putting ESG oversight processes in place at the board level and adopting a circular economy model, which aims to reuse product components and materials instead of throwing them away or recycling them.

With such considerations in mind, here are eight steps to take in developing and implementing an ESG strategy:

- Get input from internal and external stakeholders. Consult with board members and business executives about ESG issues that are important to the business. Also, talk to other stakeholders -- for example, employees, investors, customers, suppliers and community leaders -- about the issues that matter to them.

- Assess the materiality of different ESG issues. Use the input you've gathered to identify the issues that are most important to both the business and stakeholders, as well as the ones that are less important. The individual elements of the ESG strategy can then be prioritized based on that assessment.

- Establish a baseline on ESG performance. Document current performance levels, policies, practices and statistics on the ESG factors that will be addressed as part of the strategy. Doing so provides a starting point for future comparisons to evaluate the progress of ESG efforts.

- Define measurable goals for ESG initiatives. This involves setting objectives and performance targets for the ESG strategy as a whole and the various pieces of it. Some of these goals might include desired improvements on KPIs, while others might call for maintaining current performance levels and practices that already meet requirements.

- Create a deployment roadmap. Next, build out a detailed implementation plan for the ESG program with project timelines, milestones and responsibilities.

- Choose the reporting standards and frameworks to use. As covered in more detail below, numerous ESG reporting options are available to companies. Many businesses use more than one to meet different reporting and disclosure requirements. Choosing the right framework or combination of them is a key part of developing a successful ESG strategy.

- Collect, analyze and report on ESG data. Once the ESG program is operational, processes are needed to collect and analyze data on the relevant KPIs and then to prepare reports for stakeholders. The ESG data generated by an organization usually includes both quantitative and qualitative information. Full reports typically are done on an annual basis, but internal progress updates for the board and senior management are often more frequent.

- Review and revise the strategy as needed. ESG requirements can change as business needs, stakeholder concerns and regulatory mandates evolve. An ESG strategy should be reassessed regularly to make sure it's still effective and to identify required updates, including weak spots that need to be optimized.

ESG audits and materiality assessments

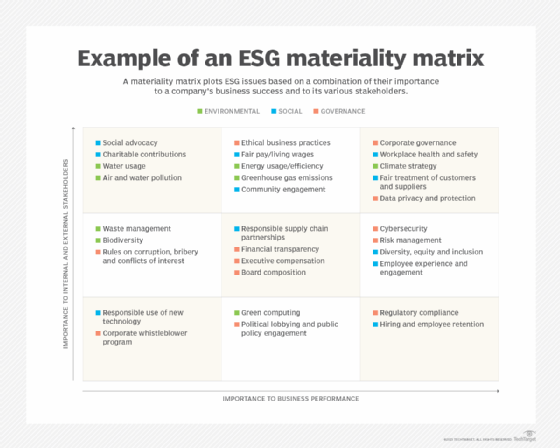

The second step in the list above is formally known as an ESG materiality assessment. Such assessments apply the financial accounting concept of materiality to ESG issues and extend it to what's called double materiality. That considers not only how material -- or important -- different ESG factors are to a company's business operations, but also their materiality to different groups of stakeholders.

Combining the materiality information provides a blueprint for ESG strategies, which can be visualized by creating a materiality matrix. It plots different ESG issues in a grid along x- and y-axes that represent their importance to the business and stakeholders, thus depicting the issues from least to most important.

In addition to helping companies prioritize ESG plans, materiality assessments can aid in creating a business case for initiatives and deciding what performance measurements to track. To be accurate, though, an assessment must begin with a comprehensive stakeholder engagement process to gather information on relevant ESG issues as well as related risks, opportunities and goals.

Later in an ESG program, ESG audits are another important step to take. They involve internal or third-party audits to verify that ESG data, performance metrics and reports are accurate and comply with accepted standards. That process is commonly referred to as ESG assurance, which can take two forms: limited assurance that involves less scrutiny and verification by the auditor, and higher-level reasonable assurance that results in an auditor affirming that the ESG information is materially correct.

An ESG audit is similar in nature to a financial audit. As a result, best practices in preparing for an audit include implementing appropriate controls on ESG data collection and reporting, establishing board oversight of the reported information and conducting an audit readiness assessment beforehand.

Examples of ESG initiatives across an organization

An ESG strategy typically includes separate initiatives in different departments and operations throughout a company. Here are some examples of what that can involve:

- IT. In the IT department, data centers are at the heart of green computing efforts because of the high amounts of energy consumed in them. To help increase energy efficiency and reduce carbon emissions, green best practices in data centers include consolidating servers and storage devices; replacing old technologies with newer equipment that uses less energy; using AI and machine learning tools to create power usage effectiveness models and autonomously manage HVAC functions; and redesigning facilities to take advantage of hot and cold aisle configurations and energy-efficient doors, windows and lighting.

- HR. The HR department plays the lead role in ESG initiatives related to employees. This can include managing DEI programs that aim to increase the representation of different groups of people in the workforce and ensure all employees are treated equally. Employee experience and engagement efforts, fair pay practices, and health and well-being initiatives -- mental health support and flexible work schedules, for example -- also fall under HR.

- Supply chain. As part of ESG programs, supply chain managers are in charge of sustainable procurement and responsible sourcing initiatives that take environmental and social factors into consideration on purchases of materials and finished products. They often also oversee supply chain partners on labor practices, efforts to reduce greenhouse gas emissions and other sustainability measures.

- Marketing. The marketing department is responsible for ESG marketing efforts that highlight initiatives, goals and progress on meeting those goals. Done properly, ESG marketing can help increase brand recognition, customer loyalty and, ultimately, revenue. But it needs to be honest about ESG plans and practices. If not, a company could face a backlash, including charges of greenwashing -- making false, unsubstantiated or exaggerated claims about environmental actions.

- Finance. The CFO is directly responsible for financial transparency and accounting integrity initiatives as part of the governance aspect of ESG. The finance department also has a hand in considering and funding ESG initiatives in other parts of the organization as part of its regular financial functions.

- Legal. Development of corporate policies on ethical business practices and rules that prohibit actions such as bribery and corruption are commonly led by the legal department.

Convergence of ESG and green IT

In addition to green computing practices in data centers, ESG strategies are converging with other approaches that aim to make technology use in companies greener. They include green IT, a broader concept that encompasses the efforts to make data centers more energy-efficient plus initiatives such as green storage, green networking and green software development.

Another aspect is green cloud, which involves the steps that cloud platform vendors are taking to improve energy efficiency and reduce carbon footprints in their data centers. AWS, Google and Microsoft have all made commitments to increased sustainability and energy efficiency, with various goals on using renewable energy and becoming carbon neutral or negative.

The growing number of IoT devices is also leading to an increased focus on how to address sustainability concerns and meet ESG goals in IoT deployments. Similarly, generative AI (GenAI) tools and other AI technologies often use massive amounts of computing and data storage resources. That creates additional energy consumption issues for IT teams to manage as enterprise AI deployments increase.

Who should oversee and manage ESG programs?

Oversight of ESG programs often begins at the board level or in the C-suite, with the CEO, COO or executive committee as a whole taking the management lead. Some companies have added a chief sustainability officer or a chief ESG officer to lead their corporate programs -- a role that's handled by a vice president of sustainability or ESG in other cases.

Companies might also have a chief diversity officer who oversees DEI programs, generally in collaboration with the HR department. Otherwise, individual ESG initiatives are typically managed by department heads, such as the CFO, the chief marketing officer, the general counsel and the CIO. The latter has a particularly big role to play in driving environmental sustainability efforts because of IT's high energy consumption and the proliferation of e-waste as systems and devices are replaced. In addition, the CIO must ensure that IT systems and tools are deployed as needed to support ESG efforts.

ESG or sustainability program managers might also be involved in overseeing initiatives at both the corporate and departmental levels. Other roles found on ESG teams can include analysts, data analysts, strategists and specialists focused on ESG as a whole or specific areas such as sustainability and community relations. In addition, teams often pull in workers from other departments on a part-time basis -- for example, risk managers, compliance managers and internal auditors.

Organizations often need to hire ESG professionals, but retraining or upskilling current employees on ESG, sustainability and green IT is also an option. Workers looking to expand their knowledge and skills in such areas can take advantage of various ESG certification programs and courses.

How to measure ESG performance and progress

A program's performance is measured through various ESG metrics. They're KPIs that, as mentioned above, can be both quantitative and qualitative in nature. The following are examples of quantitative metrics:

- Greenhouse gas emissions.

- Energy and water usage.

- Amount of waste generated.

- Compensation data.

- Employee turnover rates.

- Charitable contributions.

- Workforce and board diversity.

Examples of qualitative metrics, on the other hand, include labor practices, community engagement, codes of conduct and policies on business ethics.

ESG metrics are the key content in the reports that companies file on the status and progress of their initiatives. Metrics also help executives manage ESG-related risks and can be used by organizations to measure themselves against the triple bottom line. The TBL is a sustainability-focused management concept and framework that treats the social and environmental impact of companies and the overall economic value they create as bottom-line categories. It was designed to encourage business leaders to think more deeply about how their company operates instead of focusing only on financial performance.

ESG data collection and management

Collecting and managing data is a crucial part of ESG programs. An effective data collection process helps ensure that performance monitoring, analysis and reporting are accurate and comprehensive. It also aids in decision-making on ESG strategies, identifying opportunities to improve initiatives and managing compliance with regulations and reporting requirements.

Data quality management procedures should be incorporated into the collection process to fix errors, inconsistencies and other issues in ESG data. That includes data cleansing work plus ongoing data validation and verification checks. Data security and privacy protections should also be a priority. Centralizing data collection and management tasks enables ESG teams to standardize practices for better data consistency and reliability across an organization, especially in large companies.

Key terms to know

Read our glossary of sustainability and ESG terms that business and IT leaders should know to help set a foundation for developing an ESG strategy.

Top ESG reporting frameworks and standards

Reporting frameworks and standards provide a structured approach for publicly disclosing information about a company's ESG strategy and initiatives. They help businesses demonstrate their commitment to ESG practices and sustainable growth, while also creating transparency and accountability and giving stakeholders a detailed view of ESG programs. In addition, ESG rating agencies use submitted reports and other data to issue ESG scores to companies. The scores are either a number or a letter rating that investors and other stakeholders can use in evaluating an organization.

At first, various frameworks and standards -- most of them voluntary to use -- were developed for different reporting purposes. Efforts to consolidate and align some of them began in late 2021 and are ongoing. The following list outlines prominent ESG reporting frameworks and standards, with details on recent consolidation and alignment moves:

- IFRS Sustainability Disclosure Standards. These are a pair of standards that cover disclosures of sustainability-related financial information and information about climate-related risks and opportunities. First released in mid-2023, they're being developed by the International Sustainability Standards Board. The ISSB was set up in 2021 by the International Financial Reporting Standards (IFRS) Foundation with a goal of creating a unified set of standards for disclosing sustainability info. In keeping with that objective, the IFRS standards build on the preexisting SASB Standards (covered below) and also incorporate elements of other reporting guidelines and frameworks. The ISSB is also researching possible standards on biodiversity and human capital issues, the latter involving internal employees plus workers at suppliers and other business partners.

- SASB Standards. Released in 2018 by the now-defunct Sustainability Accounting Standards Board (SASB), they provide specifications on disclosures of financially material sustainability information that are tailored for 77 industries. The SASB Standards were consolidated into the IFRS Foundation in 2022 and are now overseen by the ISSB. Despite the development of the IFRS disclosure standards, the ISSB encourages continued use of the SASB Standards by organizations that prefer them and says it will still maintain and enhance them.

- GRI Standards. Developed by the Global Reporting Initiative (GRI), they include sets of universal, sector-specific and topic-based standards for sustainability reporting on economic, environmental and social factors. GRI published the first version as guidelines in 2000 and made several updates before formally releasing the GRI Standards in 2016. It and the ISSB are working to align the GRI and IFRS standards on disclosure topics that are common between them, but the standards will remain separate.

- CDP. Founded in 2000 as the Carbon Disclosure Project and now known just by its acronym, CDP runs a system for disclosing information on business risks and opportunities related to climate change, water security and deforestation. It then gives companies letter-grade scores in each area that can be viewed by various stakeholders. Previously, there were three questionnaires on the different topics. CDP combined them in 2024, but companies will still get separate scores. The integrated questionnaire is also now aligned with the IFRS standard on climate-related disclosures, which provides the baseline for CDP's climate questions.

- TCFD Recommendations. The Task Force on Climate-related Financial Disclosures, commonly referred to as the TCFD, was set up by the Financial Stability Board in 2015. Two years later, it released a set of 11 recommendations on the information that companies should disclose about financial risks related to climate change. The recommendations have been incorporated into the IFRS sustainability standards, and the TCFD disbanded in October 2023. Companies can still use the recommendations separately, though.

- CDSB Framework. This framework was created to enable companies to include ESG reporting in annual reports and 10-K filings. But the Climate Disclosure Standards Board (CDSB), which developed it, was also absorbed by the IFRS Foundation in 2022. While the framework is still available to use, no further work is being done on it and the IFRS climate disclosure standard is meant to take its place. The CDSB Framework's technical guidance was used as "part of the evidence base" for that standard, according to the ISSB.

- TNFD Recommendations. Modeled on the TCFD's guidelines, this includes 14 recommendations on disclosing financial information related to nature and biodiversity issues. They were published in September 2023 by the Taskforce on Nature-related Financial Disclosures. The TNFD, which was created in 2021, also provided implementation guidance. The ISSB is considering how it can build upon the recommendations as part of the potential new IFRS standard on biodiversity disclosures.

- United Nations Global Compact. Launched in 2000, the UN Global Compact is a corporate sustainability initiative that aims to align business strategies and operations with 10 principles on human rights, labor practices, the environment and anti-corruption practices. Participating companies file an annual report on their adherence to the principles.

- Workforce Disclosure Initiative. The WDI, which was created in 2016, offers a CDP-like reporting platform focused on workforce practices and management. Companies fill out an online survey on workplace health and safety, employee well-being policies and other topics to receive a disclosure scorecard from the WDI.

ESG and sustainability reporting regulations

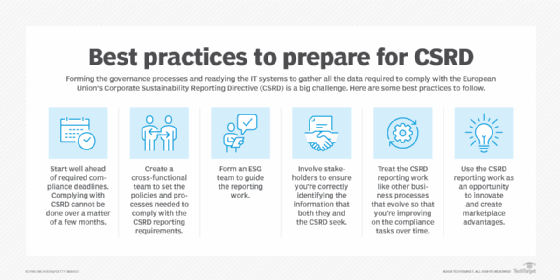

While reporting has primarily been voluntary thus far, ESG disclosure mandates are expanding. In Europe, the EU's Corporate Sustainability Reporting Directive (CSRD) went into force in January 2023. In stages starting in 2025, the CSRD eventually will require an estimated 50,000 companies to file annual reports on business risks and opportunities related to social and environmental issues and how their operations impact both people and the environment. That's more than four times the number of companies required to report under an earlier directive approved in 2014.

The CSRD could apply to some EU subsidiaries of U.S. companies or to the parent companies themselves if they meet criteria included in the directive. It adds a new set of standards for filing the required reports: the European Sustainability Reporting Standards. The ESRS include two general standards on reporting mandates and disclosure requirements plus 10 that cover specific environmental, social and governance topics. They align or support interoperability with many of the frameworks and standards listed above, including the TCFD and TNFD recommendations, CDP and both the GRI and IFRS standards.

A related measure went into force in July 2024: the Corporate Sustainability Due Diligence Directive. Starting in 2027, the CSDDD will require qualifying companies to identify and act on adverse human rights and environmental impacts in their own operations as well as their supply chains. Annual reporting on due diligence activities will also be required; companies subject to the CSRD are expected to include the due diligence information in the reports they file to comply with that directive.

Things aren't as settled in the U.S., despite recent regulatory actions. The Securities and Exchange Commission (SEC) finalized more limited rules on climate risk disclosures for publicly traded companies in March 2024. The rules would require disclosures of climate-related risks that have a material impact on business strategies or financial performance. Those impacts also must be reported, along with information on actions to mitigate or adapt to the risks. In some cases, Scope 1 and Scope 2 greenhouse gas emissions as defined by the Greenhouse Gas Protocol would need to be disclosed, too. However, the SEC stayed the implementation of the rules after multiple legal challenges were filed against them.

At the state level, the California Climate Accountability Package combining two separate bills was signed into law in October 2023. One bill requires companies that do business in California and have more than $1 billion in annual revenue to publish carbon emissions data each year. The other mandates that companies with revenues of $500 million or more publish a biennial report on climate-related financial risks. The bills also face a lawsuit, though, and Gov. Gavin Newsom's administration proposed in June 2024 that implementation of the reporting requirements be delayed from 2026 to 2028.

Common challenges on ESG initiatives

The following are some potential challenges that organizations can face in managing ESG programs:

- Data collection complexity. ESG data often needs to be collected from various internal systems and external sources. Aggregating and consolidating the data is a complicated process, and data reliability can be undermined if it isn't managed effectively and supported by sound data quality practices. Data silos can further complicate collection efforts and leave relevant data inaccessible to ESG decision-makers.

- Reporting problems. Inaccurate or incomplete data sets top the list of the ESG reporting challenges that companies encounter. In Deloitte's January 2024 survey, 57% of the 300 respondents cited data quality as their biggest reporting challenge. The increasing regulatory mandates and the various frameworks and standards that are available to use also complicate the reporting process, despite the ongoing unification efforts on the latter. Integrating ESG goals and metrics with overall business objectives in reports can be difficult, too.

- Greenwashing -- or the perception of it. In ESG reports and marketing programs, organizations need to be careful to avoid overstatements or deceptive claims about their environmental sustainability initiatives. Even the perception of greenwashing can damage a company's reputation. In some cases, that has led to green hushing -- not publicizing sustainability goals or practices. But customers and other stakeholders might then think a company isn't doing anything, also potentially causing reputational damage.

- Employee training. If an organization can't find -- or afford -- skilled ESG professionals, internal training might be required to fill out ESG teams. Broader employee training on ESG and sustainability also poses challenges. For example, the training might need to start with basic education on climate change, greenhouse gas emissions and other issues. But if a training program isn't material to the company and specific employee roles, it's unlikely to be successful.

- Lack of resources. Securing required funding and other resources for ESG programs can also be hard. In an October 2023 survey by professional services firm KPMG, insufficient resources or capacity ranked as the top challenge impeding cross-functional collaboration on ESG -- it was cited by 44% of the 550 executives, managers and board members who responded. Difficulty measuring ROI was chosen by 21% as the top challenge on allocating adequate financial resources to ESG initiatives, followed by budget constraints or competing priorities at 19%.

ESG tools and technology

Software that can help companies manage ESG initiatives is available from major IT vendors such as IBM, Microsoft, SAP and Salesforce, as well as various providers that specialize in ESG and sustainability. It's also now offered by many risk management, compliance, and environment, health and safety vendors. ESG and sustainability management software typically provides a broad set of features for data collection, reporting, analysis and carbon accounting, among other tasks.

For example, these tools can be used to measure Scope 1, 2 and 3 greenhouse gas emissions, both in internal operations and across supply chains. Major ESG reporting frameworks are commonly supported. The software can also be used to conduct ESG materiality assessments, track metrics and, in some cases, support DEI programs and other social ESG initiatives.

In an April 2024 report on sustainability management tools, Forrester Research said the following features were among the criteria it used to evaluate software products for the report:

- Support for materiality assessments.

- Data collection capabilities, including native integrations.

- Data quality management and standardization functionality.

- ESG and environmental strategy management.

- ROI calculations.

- Audit and compliance management.

- Environmental risk assessment.

- Supplier policy management.

- Reporting.

- Sustainability intelligence tools and dashboards.

ESG trends and developments to keep tabs on

In addition to the convergence of reporting frameworks and standards, the following are some ongoing trends to be aware of in planning and managing ESG programs:

- Growing use of AI tools in ESG initiatives. As mentioned previously, IT teams have been using AI and machine learning as part of green computing efforts in data centers. But the use of AI in ESG and sustainability programs is expanding into other areas. For example, AI tools can also analyze energy use in offices and manufacturing plants, as well as environmental issues in supply chains. Climate change modeling is another potential environmental use. On social and governance factors, potential uses include identifying workplace health and safety issues, bias in hiring and promotions, and ethical lapses. AI can also aid in data collection and management, and GenAI tools can help write ESG policies.

- Increasing need to manage AI-related ESG risks. Conversely, the expanding use of AI in enterprise applications creates new risks across the ESG spectrum. As mentioned previously, AI tools are resource-intensive and can have a significant environmental impact. While AI can help identify bias, it can also amplify human biases if algorithms aren't coded and trained carefully enough. The use of GenAI and other AI technologies also poses various ethics, privacy and compliance risks. All these issues need to be addressed as part of an ESG program.

- Anti-ESG lawsuits and legislative efforts. The lawsuits against the SEC over its climate risk disclosure rules were filed by a combination of Republican-led states, energy companies and business groups. Politicians, mostly on the Republican side, have also targeted ESG initiatives in legislation at both the federal and state levels. For example, Congress in March 2023 approved a resolution to block a federal rule that lets retirement fund managers consider ESG factors in investment decisions; President Biden vetoed the measure. Numerous bills looking to limit ESG investing and DEI initiatives have also been filed in various states. While many of the bills have been rejected, watered down or challenged in court, ESG is likely to remain a political football.

This article was updated in August 2024 for timeliness and to add new information.

Craig Stedman is an industry editor who creates in-depth packages of content on analytics, data management, cybersecurity and other technology areas for TechTarget Editorial.