What is ESG reporting?

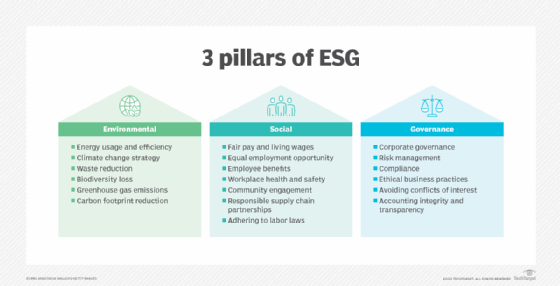

ESG reporting is a type of corporate disclosure that details the environmental, social and governance (ESG) promises, efforts and progress of an organization.

Although organizations have long had to report on financial and operational performance attributes, ESG reporting is a newer phenomenon that gained traction in the early 2000s. The term ESG describes an organization's sustainable and ethical impact on the environment, society and governance.

An ESG report is an opportunity for an organization to provide a milestone update on progress toward environmental, sustainability and corporate governance goals. Its aim is to provide an accurate account of efforts undertaken and the expected impact of those efforts from both a qualitative and quantitative perspective with ESG data. An ESG report is much like an annual report or other forms of corporate disclosure, serving as a communication tool to provide information to employees, investors and regulatory authorities.

Why is ESG reporting important for organizations?

ESG reporting is important for many reasons, making it a corporate mainstay across industries and jurisdictions:

- Transparency. As concern about climate change and corporate social responsibility increases, organizations must be transparent about how their operations affect these areas. ESG reporting provides that transparency, giving organizations ways to report on ESG efforts and progress.

- Investor demand. Investors have long relied on all manner of ESG metrics to gauge the value and growth potential of an organization. An ESG report is another critical piece of information used to help make investment decisions.

- Brand loyalty. Consumers choose to do business with organizations that align with their beliefs about governance and sustainability. Consumers are likely to exhibit more brand loyalty with those organizations that report on ESG initiatives and progress in areas they value.

- Compliance. There are a growing number of regulations globally requiring organizations to disclose and report on ESG initiatives, sustainability and governance. An ESG report provides a way for organizations to make proper disclosure and helps ensure regulatory compliance.

- Risk management. ESG-related issues can expose organizations to risk. An ESG report is an opportunity to get ahead of those issues by disclosing activities and identifying potential areas of risk, such as negative environmental impacts or supply chain disruptions.

- Innovation. ESG reporting can also offer business benefits that help drive and improve ESG strategies. Reporting can be the driver that pushes an organization to enhance efficiency and identify areas that need improvement.

- Goal tracking. An ESG report is a way for organizations to be accountable for their ESG performance, claims and strategy. It also helps them track progress on goals, as many targets are multiyear, long-term strategies that play out over time.

Are companies required to do ESG reporting?

Depending on the location of a company's headquarters, there can be national or local jurisdiction-level regulations for ESG reporting. Specific industries are also putting out a growing number of regulations calling for some form of ESG reporting.

In the European Union, the Sustainable Finance Disclosure Regulation went into effect in March 2021. It requires ESG reporting with a focus on sustainability-related initiatives. That regulation is complemented by the Corporate Sustainability Reporting Directive, which went into effect in January 2023. The CSRD strengthened EU social and environmental reporting rules. Large organizations in the U.K. are required to report using the Streamlined Energy and Carbon Reporting (SECR) framework.

Publicly traded corporations have come under increasing pressure in recent years to have ESG reports.

The U.S. Securities and Exchange Commission adopted rules to standardize how public companies report climate-related risk in March 2024. Individual exchanges, including the New York Stock Exchange and the Nasdaq composite, have encouraged issuers to provide ESG reporting.

In October 2023, California enacted two laws that require large businesses operating in the state to disclose climate-related financial risks and their efforts to mitigate such risks. They are called the Climate Corporate Data Accountability Act and the Climate-Related Financial Risk Act. New York and Illinois are developing similar laws requiring large businesses with more than a billion dollars in revenue to report environmental information, such as emissions.

Although ESG reporting isn't mandatory at the federal level, a 2023 report from the Governance & Accountability Institute found that 98% of companies on the S&P 500 index have published an ESG report.

ESG reporting might not be a legal or regulatory requirement for all companies in every jurisdiction, but not having a report can lead to issues. A company that doesn't have an ESG report will be conspicuous in its absence, leading potential investors, consumers and employees to question its position on ESG issues.

ESG reporting frameworks to consider using

ESG reports follow a specific approach or framework that provides guidance and structure on how the report and its findings must be measured and communicated. There are many reporting processes and frameworks that organizations can use:

- Carbon Disclosure Project. CDP was founded in 2000. Companies use its environmental disclosure framework to report on climate-related business risks and opportunities and other environmental topics. Over 18,000 companies worldwide use this framework, as well as many city governments.

- Climate Disclosure Standards Board Framework. The CDSB Framework was a model designed to help organizations measure the environmental side of ESG reporting. Although the framework is still used by some ESG reports, the CDSB was merged into the International Financial Reporting Standards (IFRS) Foundation in January 2022 to create the International Sustainability Standards Board (ISSB) alongside the Sustainability Accounting Standards Board (SASB).

- Global Reporting Initiative Standards. The GRI Standards aim to provide a set of sustainability standards for reporting. GRI has segmented its reporting model into a modular approach that includes sector standards for specific industries and a universal standard that applies across all domains.

- IFRS Sustainability Disclosure Standards. The ISSB, which is part of the IFRS, developed a new set of standards that builds on the CDSB and SASB frameworks. The new framework is an attempt to create a consolidated and comprehensive view of sustainability efforts in a reporting organization. Its first two standards -- Sustainability Disclosure Standards IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and IFRS S2 Climate-related Disclosures -- were released in June 2023.

- SECR. The U.K. has developed its own reporting framework and guidance for ESG reporting. The SECR goes beyond reporting numbers alone, requiring that organizations provide a detailed explanation of sustainability efforts. The SECR makes use of greenhouse gas reporting standards to provide a method for reporting on carbon emissions data.

- SASB. The SASB Framework incorporates ESG information into financial reporting on an organization's sustainability efforts. SASB got its start in 2011. In 2022, it was consolidated into the IFRS Foundation to build a new framework for ESG reporting.

- Taskforce on Climate-related Financial Disclosures. The Financial Stability Board created the first set of TCFD recommendations in 2017. The TCFD approach included four thematic areas: governance, strategy, risk management, and metrics and targets. These areas were interrelated and support 11 recommended ESG disclosures that provide information for investors and other interested parties to understand how companies evaluate and address climate risk. The TCFD disbanded in 2023.

- United Nations Guiding Principles Reporting Framework (UNGPRF). The United Nations has many reporting frameworks that are applicable to ESG; among them is the UNGPRF. The focus of the UNGPRF is on ethical governance and issues related to human rights. Alongside the UNGPRF is the complementary United Nations Global Compact, which provides guidance on helping organizations adopt sustainable practices.

- Workforce Disclosure Initiative. A charity called ShareAction, which supports responsible ESG investments, created this framework in 2016. Its surveys are focused on reporting workforce management data. In 2022, 167 companies worldwide participated in the survey and shared their workforce management policies as well as other information such as employee well-being, health and safety initiatives.

ESG reporting challenges

ESG reporting isn't as simple as preparing a report based on accessible information and knowing exactly what to include. Common challenges with ESG reporting include the following:

- Locating and collecting ESG data. Finding and collecting data from many sources is particularly difficult for larger companies. Raw data can come from devices, databases and team members tasked with monitoring physical assets. It can take significant effort to collect this data.

- Enlisting experts. Not every organization has in-house resources with the experience and skills needed to prepare reports. Outside expertise might be needed.

- Data collection. Documenting data sources and who's responsible for managing each source is a difficult but necessary task. It might require software tools to make the process easier.

- Choosing and applying frameworks. Vetting the different ESG frameworks that are available to find the one that's suitable for an organization's reporting needs is challenging. It's common practice to combine multiple frameworks to produce comprehensive reports.

- Regulations. The changing regulatory environment presents a range of reporting requirements and complications. Companies must understand what regulations apply to them and be ready to deal with new ones.

- Internal resistance. Some people and departments within an organization might resist ESG reporting. They might view them as impeding economic growth and skewing investment decisions.

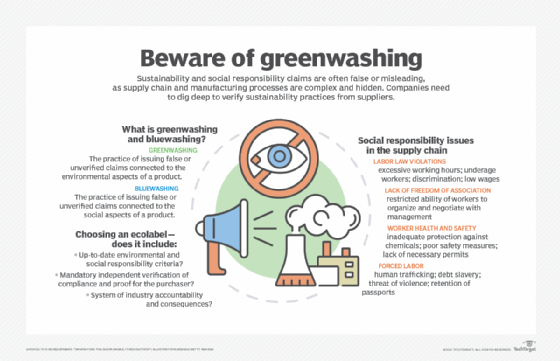

- False reporting. Greenwashing is the practice of falsely claiming that initiatives are producing positive environmental and social outcomes, when that isn't the case. Marketers, in particular, can make this mistake when they exaggerate or make unsubstantiated claims about a product or a company's role in the world.

Components of an ESG report

ESG reports vary in structure, yet they typically include key components and sections. The following are some common ones:

- Executive summary. This is a brief summary of the ESG efforts an organization has undertaken.

- Environmental policies. A section dedicated to the organization's environmental impact of its supply chain, manufacturing and other processes. It includes policies and initiatives around pollution, emissions and waste control, as well as undertakings such as reforestation.

- Social policies. This section covers the organization's policies and metrics in areas such as labor practices, workforce diversity, community engagement and data privacy.

- Governance. In this section, boards of directors and executive management teams demonstrate how they operate ethically. This can include showing how executive compensation is determined, diversity in the makeup of the governing body and transparency in decision-making.

- Conclusion. The report concludes with a statement of where the organization is at with its ESG practices and where it sees its efforts going in the future.

Best practices and tips for effective ESG reporting

ESG reporting can be a complex and time-consuming operation. As with any type of corporate disclosure, accuracy and diligence are important. The following are tips for effective ESG reporting:

- Define objectives. Have a goal in mind for what the organization wants to achieve. Having well-defined ESG goals and highlighting ESG risks and opportunities are critical at the earliest stages of reporting.

- Identify stakeholders. Understand who in the organization has a stake in the ESG goals, what their interests are and how they can help steer ESG efforts.

- Get expert advice. Depending on the industry, various experts can help provide information on the best ways to do ESG reporting.

- Understand the data. Make sure the ESG data that's collected is precise and confirmable, and that it's gathered in a dependable and open way.

- Provide context. ESG reporting should be more than a compilation of figures and measurements. There also must be context around ESG efforts to provide perspective on the efforts.

- Use a framework. Adhering to an existing ESG framework is important. It provides guidance and best practices for how the organization should structure and convey the report and its data.

- Review and repeat. An ESG report isn't a one-time task; organizations must review, update and improve it every year.

The environmental angle of ESG gets a lot of media attention. However, the social aspect is also crucial. Learn ways to manage the social aspects of ESG.